The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

**MACRO** - A bit of a rough day for equities which find themselves 1% and 1.5% lower respectively on SPX and NDQ to end the week. It appears there's been some weakness in the chip-making sector (a strong performer this year due to the derived AI demand) after TSMC (the largest in the world) asked suppliers to delay delivery of some upper-end chipmaking equipment. Yesterday we finally saw the ARM IPO launch and it traded up just under 25% on its first day and looks like it's progressed a little bit higher once again today. Interest rates seem to be selling off once again ahead of next week's FOMC, we're up to 5.04% on 2Y and 4.32% on 10Y...this comes after a decent move higher in oil this week which takes WTI crude up to $90/barrel, the highest we've seen in a year and will certainly put some inflationary pressure back on.

**CRYPTO** - Settlings at 26.2k and 1615 this am on BTC and ETH with crypto levels shedding some gains but still up a decent amount off the lows. It looks like altcoins are getting slashes a bit today with most things down about 5-10%. It's been a year since the ETH merge as of today and we've seen BTC decently outperform ETH in that time period but I think that's mainly due to "flight to quality" in a bear market. Since the merge, about 0.25% of ETH supply has been burnt, which is about a 3.4% swing vs if we had stayed on PoW. That's pretty insane when you think about it on an annual basis and the future. Of course the rate of burn can vary and it can even be inflationary, but it makes you wonder how parabolic ETH could really get once we get to full bull mode. The other point worth mentioning is that BTC broke above its 4H 200MA for the first time in a few months; indeed I'm not a chartist nor do I really believe in it but that will be a key level for those who do with 25K having been a key support level that we bounced off. Mando tells me he thinks the lows are in on BTC for this year; I hope he's right.

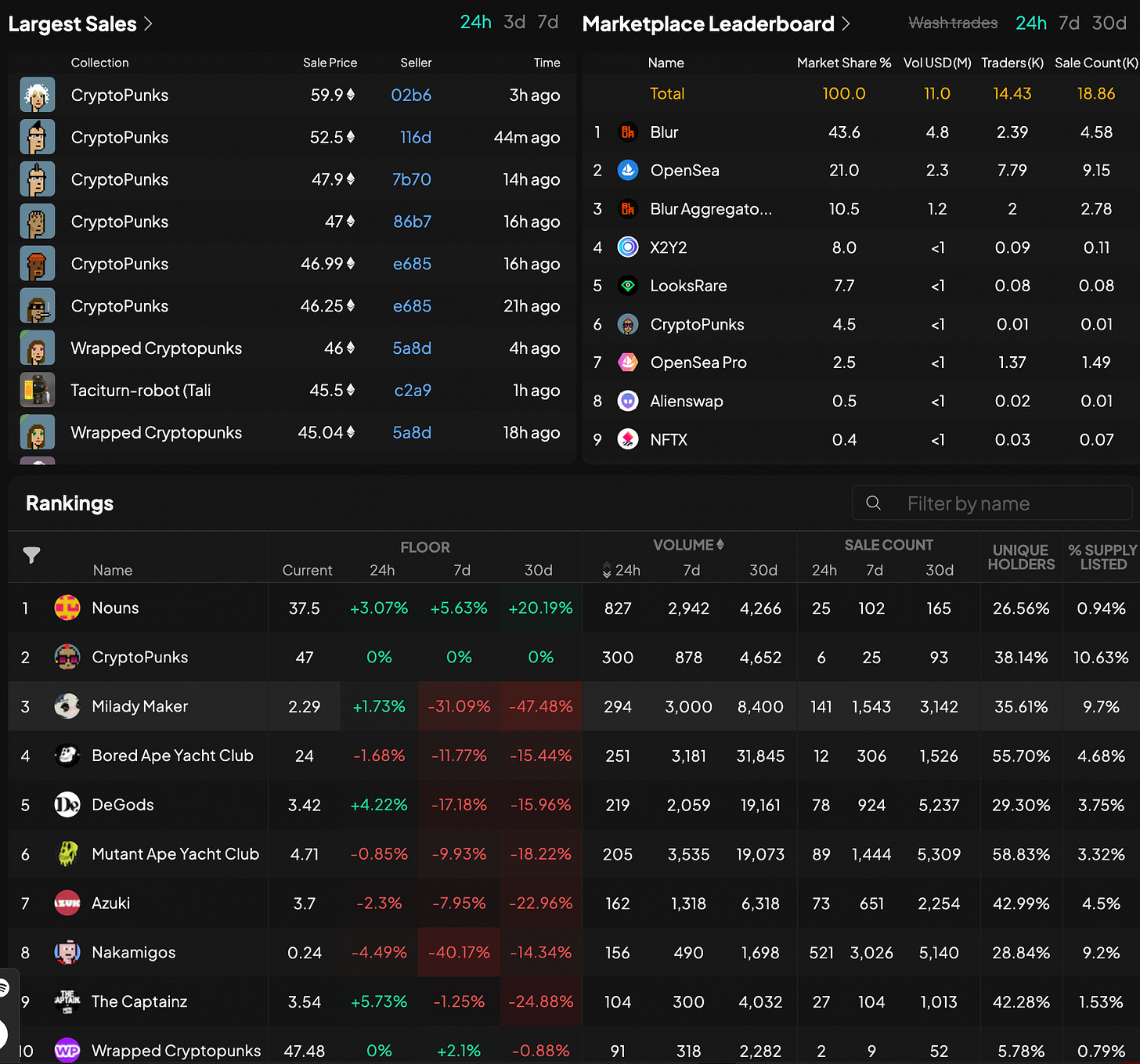

**NFTs & Misc** - In a shock turn of events we saw the Nakamigos founders listen to community feedback and make the Cloaks a free mint. TBH I still think it's a little cheeky, I think these guys know what they're doing and know how to read the room, personally I think they just tried their luck to see if they could get away with it and it seemed like they couldn't so then they flipped, capturing plenty of trading fees in between. The floor rose back to 0.24ETH so we're still meaningfully lower but at least off the lows. Elsewhere pretty quiet on the NFT front with a slow bleed. We continued to see a lot of FT activity yesterday as it was the second biggest fee generator in crypto ranking second only to Ethereum. We saw users grow another 77% to over 9k but TVL remained unchanged and the daily buy volume dropped by 5%, which explains the price action we saw across many keys as lots of people took profits. Friday is when you get your airdrop points so could be linked to that.

**REPORTS** - Today we look at two reports we are adding to the degenz list, bringing the total to 432. First is Nakamigos Revisited due to their reveal of their latest endeavour Cloacks. The team have captured a lot of attention in the space, with speculation of Beeple and Larva Labs being on their team. Whilst what goes on in the background isn’t certain, what is coming in the future with the potential of a videogame owned by the community is very exciting indeed. Our second report is Reply Guys. If you think you are one yourself, this is definitely the project for you as they aim to be the first ever NFT project to reward holders for their engagement and activity. Make sure to read our full in depth reports for all the details

GL today!