The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

**MACRO** - Equities closed the day unchanged yesterday while futures are up smalls this morning. The big mover continues to be interest rates which have ratcheted in even lower with 2Y now down to 4.8% and 10y to 4.39%. It's the lowest we've been on 10Y since mid September before we had that crazy payrolls number. So yeah on the whole it does feel like the market is starting to show signs of becoming a bit less hawkish here. Remember, the focus next year is going to be all about "wen rate cuts" and most people expect H2, but if the data continues to trend in the current direction then there is a good chance we get it earlier, which markets would like.

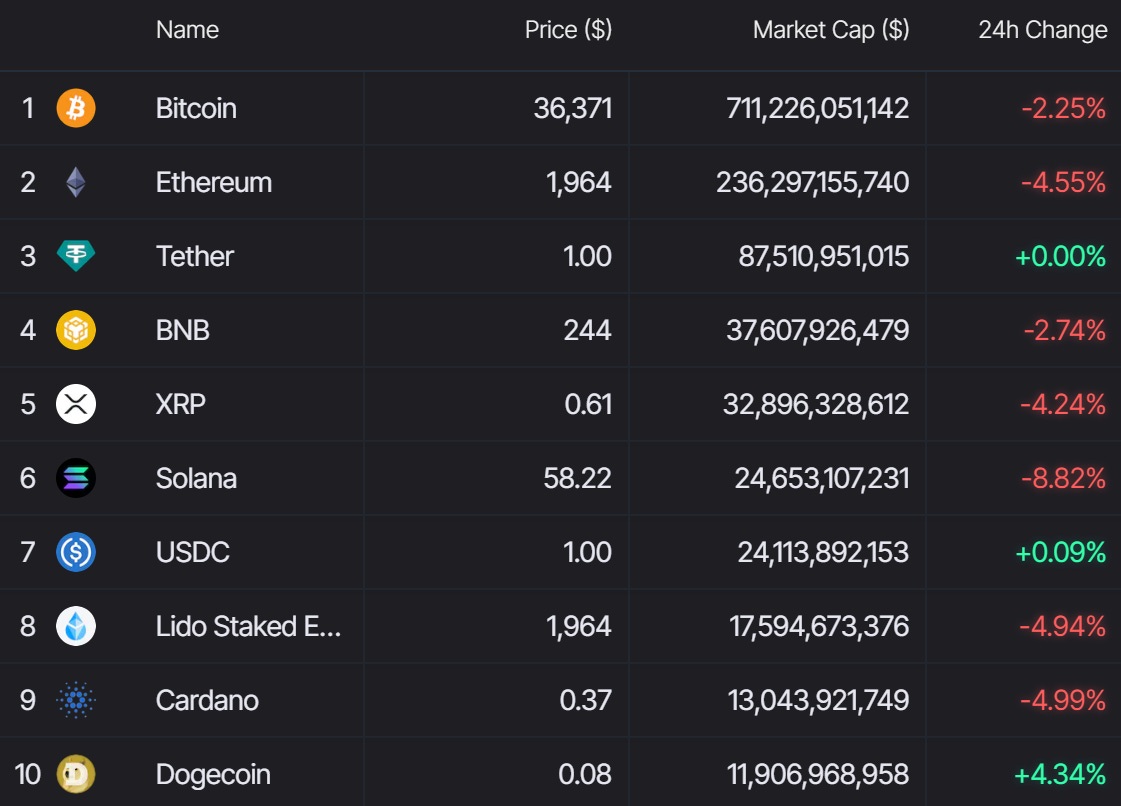

**CRYPTO** - We continued to drift lower yesterday which now sees BTC at 36.3K and ETH at 1960, so just off local lows. We've seen some of the recent altcoin winners pull back with SOL and AVAX dropping off a decent amount. It looks like there were about $200m in liquidations in the last 24H while funding rates still look pretty high to me so I guess we continue to see some friction in the market, although it's worth noting that OI changes in the last 24H look like they are -10 to 20% across the board which I think is encouraging; ie it means there's less leverage in the system. I think it may be a good dip to buy but would advise DCAing and only taking very low leverage. For me personally I'm just going to sit in spot positions for a while and see how things shake out; it seems a forgone conclusion now that we will not get a BTC ETF approval this week and it feels like the base case is shifting back towards it being a January event. Something worth noting is that $DOGE is up a decent amount and I think that's an important one to watch because it will lead larger cap memecoins and in general rerack people's expectations of market caps. Last cycle $DOGE got to $80bn which means there were plenty of memes that found it easy to get to $1bn market caps, so I think that's worth keeping in mind.

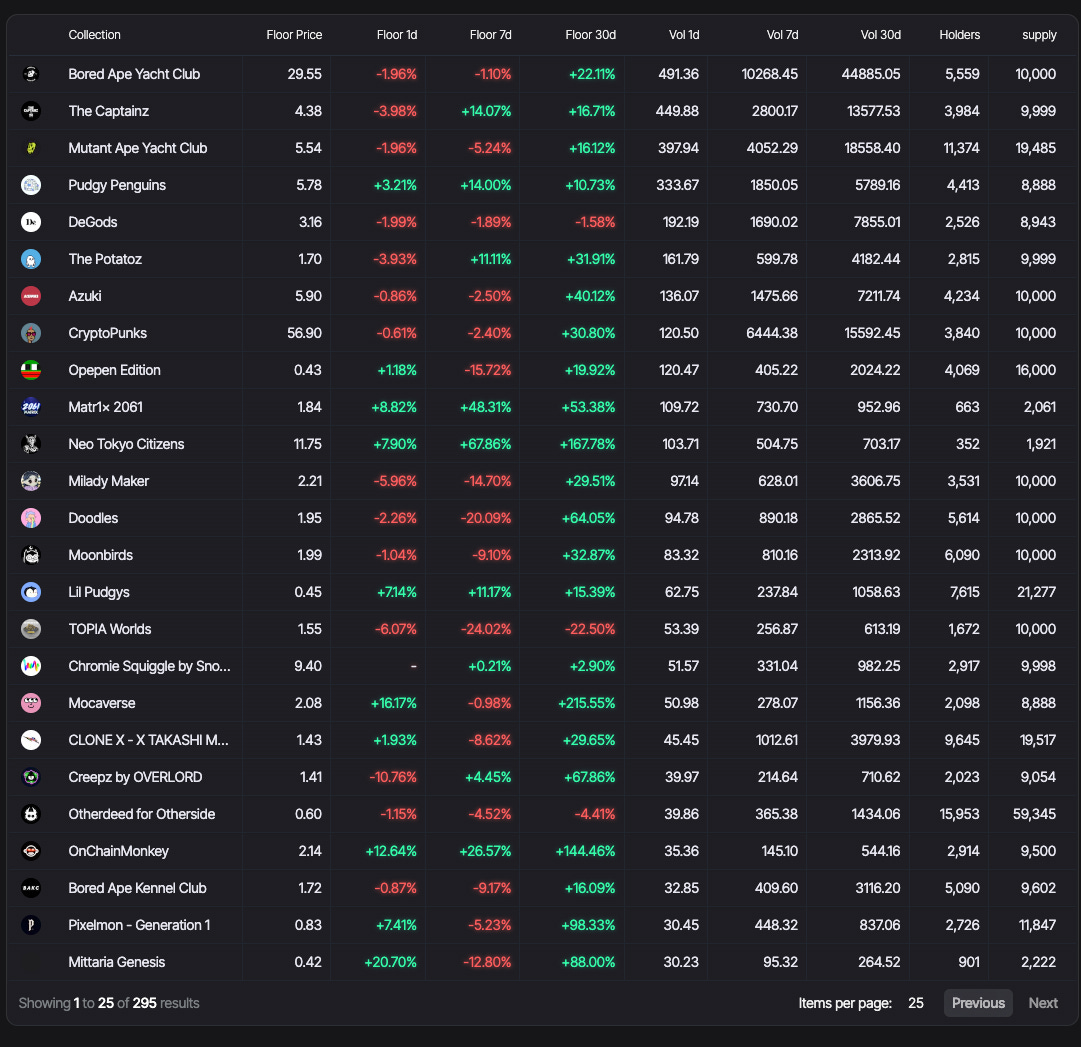

**NFTs** - Mixed price action at the moment, with some things down some things up but there don't seem to be any major moves beyond 3-5% while volumes remain low. There were some big OTC sales yesterday as a mysterious buyer purchased some of the former 3AC "grails" assets from Sotheby's which included Fidenzas, Ringers and XCOPY 1/1s. Always encouraging to see that kind of activity I think and it's a testament to the fact that money continues to want to be invested in the same things that were perceived as grails 2 years ago. Elsewhere not a lot in terms of price action, it was interesting to see TaprootWizards, an Ordinals project led by Udi Wertheimer raise a whopping $7.5m in a seed round...curious to see where they take that and end up doing with that one!

Find all of our charts on Degenz.Finance and make sure to subscribe to the Mando Minutes Newsletter at mandominutes.com for even more news on the Macro, Crypto and NFT landscapes:

GL today and touch grass this weekend!