The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

**MACRO** - A meh start for equities which are unchanged on SPX and up 0.1% on NDQ to start the week. As it stands we are up 15.5% and 38% on both YTD, I can't help but think we see some profit taking in Q4 but arguably we already saw a lot of it over the summer given equities saw a dip and a rebound in that period. The big question is if people think there is enough meat on the bone to post further positive returns next year and breach ATHs, imo with a strengthening AI narrative it's very possible and market players who greatly benefited from the tech boom of the past decade will have that in the back of their minds. It's not looking pretty for interest rates however with 2Y still at 5.05% and 10Y at 4.34%. This week we get the FOMC which starts on Wednesday and concludes on Thursday. Expectations remain for the Fed to hold interest rates (ie not hike or cut) and the market will be looking for commentary on the plans for the rest of the year, but more importantly if the Fed can signal any cuts for next year.

**CRYPTO** - We are seeing some renewed crypto strength after a weekend of soft price action with BTC back above 27K for what I believe is the first time this month. Similarly ETH has kicked on a little to 1657. The ratio remains at 0.061 but it feels like to me if I were to get more precision, BTC would have outperformed. BTC dominance also remains at 50.2% but similarly I think BTC is outperforming most alts here. IMO that is a healthy sign, once again, just seems like the overhang of BTC has dissipated somewhat and it's almost as if the market is kind of asleep to it. Would be nice to see us kick on back up to 30k here and I think that would carry some alts along with it.., that's the hope in it.

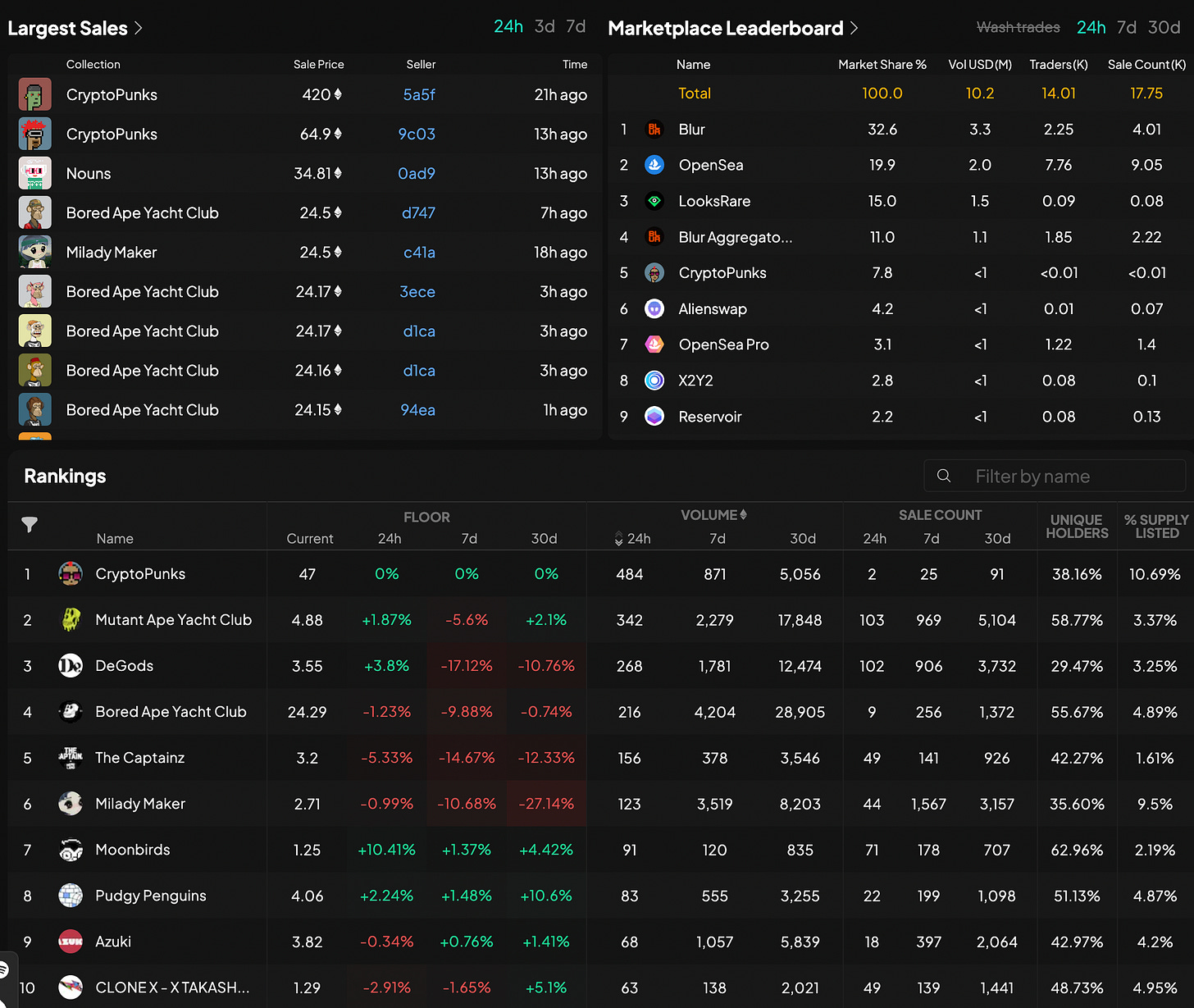

**NFTs & Misc** - Flat price action on the whole in NFTs, with Moonbirds being an unlikely outperformer up 10% to a FP of 1.25ETH. We finally saw a big NFT sale after a long while with there being a Zombie CryptoPunk sale to the tune of 420ETH ($693k), certainly a far cry from the $5m prints we saw in the peak of the bull market and sometimes I wonder if we will ever reach those heights again. I personally think it's a good/cool buy and I think when it gets to that part of the market people tend to buy for a flex/brag rather than because they necessarily think it's going to outperform certain assets out there. Elsewhere FriendTech continues to be active with TVL hitting a new ATH up 6% to $35.9m. Interestingly the rate of growth of new users has substantially slowed, with new users hitting 8350 yday, down from 13727 the previous day (so a 40% slower growth rate). It appears the activity has come from a wider adoption of the (3,3) meta; I buy you you buy me and we hold for the airdrop. I think this will work short term and will boost the values of many different keys, but at the end of the day the ones that will be most valuable will remains as rooms people think are worth being in and we will see some price normalisation as time goes on, and also as things get more efficient -- expecting more bots and automated farming soon.

GL this week!