The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

MACRO - A strong day for stocks saw SPX and NDQ climb 1% and 2% respectively yesterday. This puts SPX at 4060 and while the NDQ has breached 12K for the first time in a while. At these levels we're close to what look like 3-month highs and the next point of resistance will be if we can get back to levels last seen in August. Interest rates have been slowly drifting higher with 10Y now at 3.53%...what's funny is that the way everyone talks about the market it implies the two should be inversely created but I think we're sitting here with stocks up YTD and also rates slightly higher. I suppose there is a scenario of "inflation coming lower" while the "economy being fine" which could cause that scenario to sustain. At this point we are now one week away from payrolls, but more importantly the Fed will actually conclude its next FOMC and hold a press conference on 1st Feb (actually before payrolls). Given its timing, the Fed won't have much new data to act on and we already got some Bullard comments after the most recent PPI number. IMO I would view the upcoming FOMC as potentially a short-term bearish event as so far they continue to want to put a dampener on things and not fuel a market rally. I think that dip is then meant to be bought. I'm not much of a short-term trader but if recent history is anything to go by that would be my bet.

CRYPTO - We seem to have given up some recent gains with BTC drifting a hair below 23K and ETH back down to 1580. ETH continues to underperform and if you look at the ETH/BTC chart you can see it's moved from 0.078 to 0.069 in the last two weeks alone; that ratio is also about to retest what seems to be a big support line that's held for about 6 months.

Altcoins seem to have clung onto their recent gain, with $APE continuing its ascent rising ANOTHER 5% to hit a price of 6.3. Staking has been live for 46 days now, in that time you would have earned over 25% purely just from staking. The price on 12th December was 4.4, so that's a 43% return on token appreciation. Those two things compounded has so far given you a return of almost 80% to date. Of course, it's only paper profits until you sell and that's going to be the challenge here; I continue to think 2-3 weeks before the supply unlock would be a wise decision:

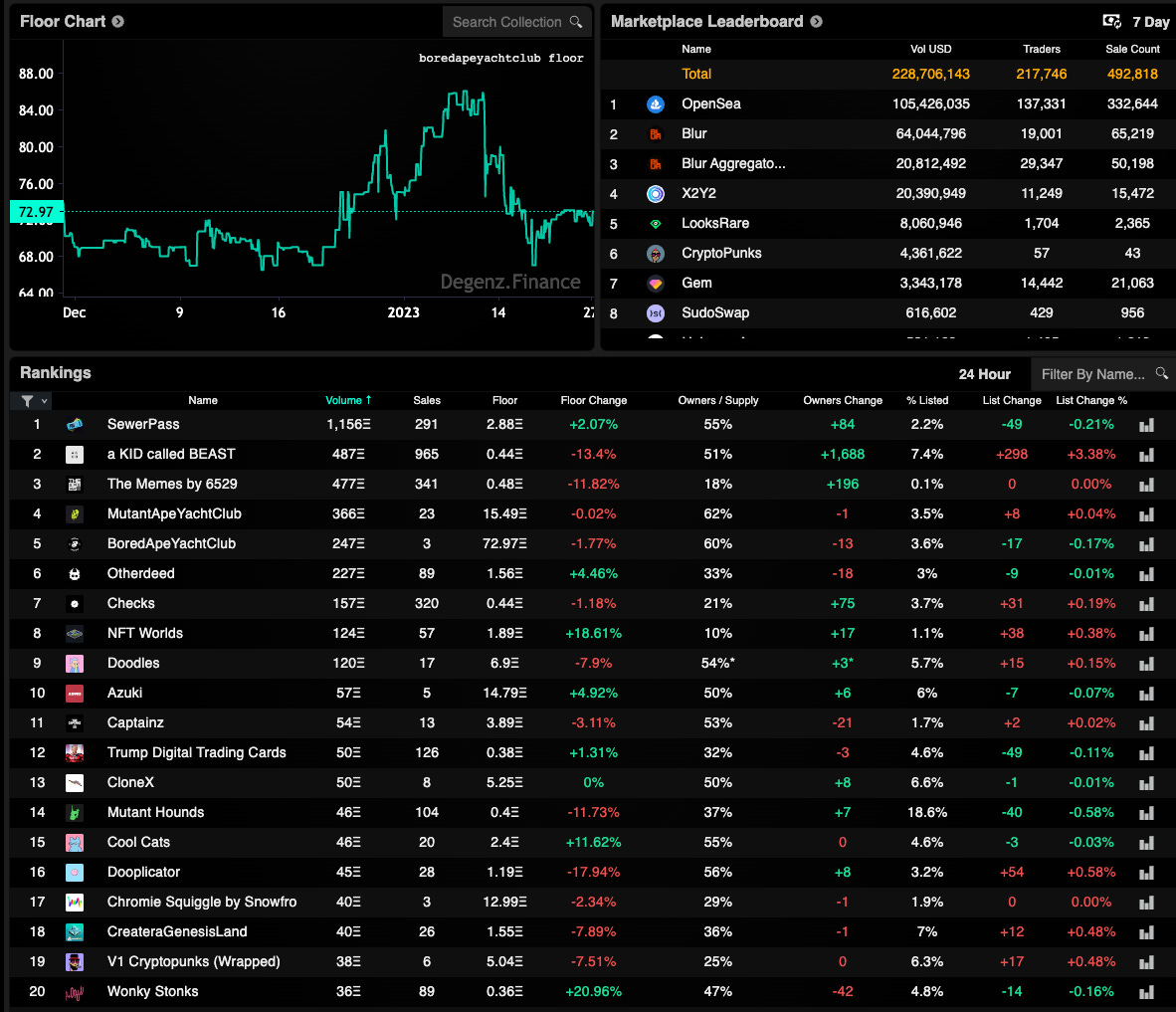

NFTs - I'm really impressed to see Sewer Passes maintain both volumes and price action with another 1.1K ETH going through and the floor actually climbing by 2% to 2.9ETH. We continue to see very active trading in 6529's meme collections which posted another 500E of volumes despite declining by 12%. Two things I am seeing a lot of rn are memes and open editions. IMO, given how the market is, there are a lot of bots buying and a lot of people buying speculatively to flip; let's not kid ourselves about what the NFT market is. When there is lack of an overall macro rally, NFTs become "the next hot or shiny new thing" each week and that meta can drastically change. So that's not to say don't buy art you love, and it's not to say that it's amazing to see cheap art available for all...but it is to say don't over-extend yourself and if you own things you aren't happy to underwrite to zero, then make damn sure you're not the last one holding the bag because it's inevitably going to be someone and they will be upset. My gut is that post $BLUR airdrop we see focus shift back to liquid pfp/collectibles and I think the market starts to chase that. The other thing I would say is given the huge increase in supply with art OEs, the next down move is going to feel a lot more brutal in larger-supply collections.

GL today and touch grass this weekend!