The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

MACRO - We had another remarkable rally in equities yesterday which saw SPX close 1.5% higher and NDQ close 3.6% higher. It takes the NASDAQ to a level not seen since September 2022. Despite that, trading was certainly choppy and we saw a bit of a whipsaw in stocks yesterday. Interest rates seem to ahve stayed relatively stable with 10y around 3.4%. I would reiterate that my takeaway from the week so far is that markets are rallying based on an increased probability of a soft landing scenario rather than any near term rate cuts and I think interest rate price action kind of tells you that (ie rates didn't rally as much as some people would have thought). Today we get payrolls for which consensus is 185k. As I mentioned yesterday I'm not really sure what to expect...because further to what I just said, if we come massively below 185 then it flips that narrative around again. IMO the "best" number is probably something in line. It does beg the question though, if we beat, if it's a good thing, because it plays into Powell's narrative of him now expecting inflation to come lower while growth stays positive, albeit slower. I guess what we want to see is something in line or even a small beat, if it's a big beat then I think people start to get worried about the Fed again.

CRYPTO - With the NASDAQ closing 3.5% higher yesterday I feel crypto definitely lagged the move. We say BTC hover below 24K and ETH briefly wick above 1700, but those gains were quickly lost with current levels on majors now at 23.4k and 1643. There's an argument to say that given crypto outperformed a lot this year that it's just a normalisation, but tbh, if we do see continued upwards price action it means crypto has a lot more room to outperform. It's pretty insane that stocks like $META which has a market cap of roughly half that of the entire crypto market are demonstrating similar moves...if this continues I find it hard not to think crypto can keep going higher. My guess is a lot of people were long into the year and we're seeing natural points of profit taking. With stuff like SOL and CANTO displaying multiple unit returns, I think people feel a little gun shy to buy and rightly so. But remember, a 3x or 4x in crypto is not even really a "huge" return...let me put something into perspective for you...ETH is still down 67% from the highs, BTC down 66% and SOL down 91%. I'm not calling for a return to ATH this year, but it gives you some perspective.

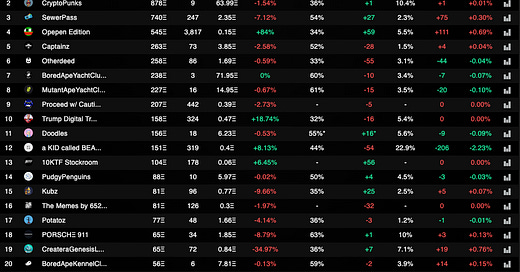

NFTs - Today we admire the incredible rise of Jack Butcher's Checks which rose an additional 58% overnight to a floor of 1.64ETH, on 1.7K ETH of volumes overnight. It's incredible to see an open edition surpass the price of projects such as Otherside, RENGA, Beanz, World of Women and of course many more. I think that goes to show you not all OEs are bad and some can be pulled off well if they are meaningful and Jack has done an incredible job. Despite having 16k supply, it looks like unique owners there are just 25% and of the top 100 holders it seems there are only 15 listed (you can view this data on Degenz). Curious to see how this one ends, and of course, with something having risen so quick so fast I would always caution against FOMO. Elsewhere it actually seems like most projects are down in price by about 5-10% and my guess is liquidity from these went into chasing OEs, memes and what not and people have lost money doing so. Total market volumes in last 24H are $37m which takes us to about $213m on the week. Not bad for NFTs that are dead. GL today and touch some grass this weekend.

Discussion about this post

No posts