The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

MACRO - We had a very strong close to equities on Friday with SPX and NDQ both closing 1.9% and 2.9% higher respectively. There continues to be this theme of "the market vs the Fed" where the Fed continue to be very hawkish while the markets simply don't really believe it. At present interest rate futures are actually pricing in rate cuts by December 2023 (to the tune of 50bps), with probably something like 1.5-2% of cuts in 2024. Honestly, if any of these things materialise I think that's very, very bullish for the market. TBH, as it stands I'm finding it hard not to be very bullish at this point. I'm not talking about near-term price moves, what happens tomorrow, next week or even next month...but over a span of 18-24 months I think we are going to see some big positive returns from where prices on risk assets are now (once again, barring black swans...tails always exist). The thing is, the Fed wants stability, not a surge in stocks, and they know full well as soon as they make any communication wrt a pivot the market is gonna absolutely gun it. So we're at this weird stand-off. The other thing I'd say is there is a lot of press out there now talking about a "soft landing" scenario, ie the Fed successfully gets inflation lower without destroying the economy. A low probability event and something I spoke about last year, but it's certainly a non-zero event and plants the "what if" in your head.

CRYPTO - Some solid price action on Friday that seeped into the weekend a little bit takes BTC above 22K and ETH at around 1634. We saw a monster rally in a bunch of altcoins which includes $APE, $MAGIC, $SOL and more. Inevitably I think we will get an altcoin season once again (probs in 2024 in line with the narrative people will pitch with the next bitcoin halving) but one thing that I think is important to remember is it's not the same altcoins that rally from the last cycle (barring a few), it's usually the new ones that come. That's usually because so many people get rekt in one cycle, coupled with more lockups expiring, that it just creates massive technical supply. The $APE rally continues to be extremely impressive given you've been able to stake this year for between 100-200% for most of it. I think the rally comes after the success of its Dookey Dash game which has gone somewhat viral...again...impressive given it's not open to those without a Sewer Pass. I've always been of the view that AAA games take years to make and it'll be tough for anyone to compete, but then I realised the simplest of games often go viral, such as Temple Run, Angry Birds, Wordle...etc etc. Now imagine these games are P2E with interoperability, and now imagine that $APE is the in-game currency. Of course there's execution risk etc but it's hard not to get excited about it.

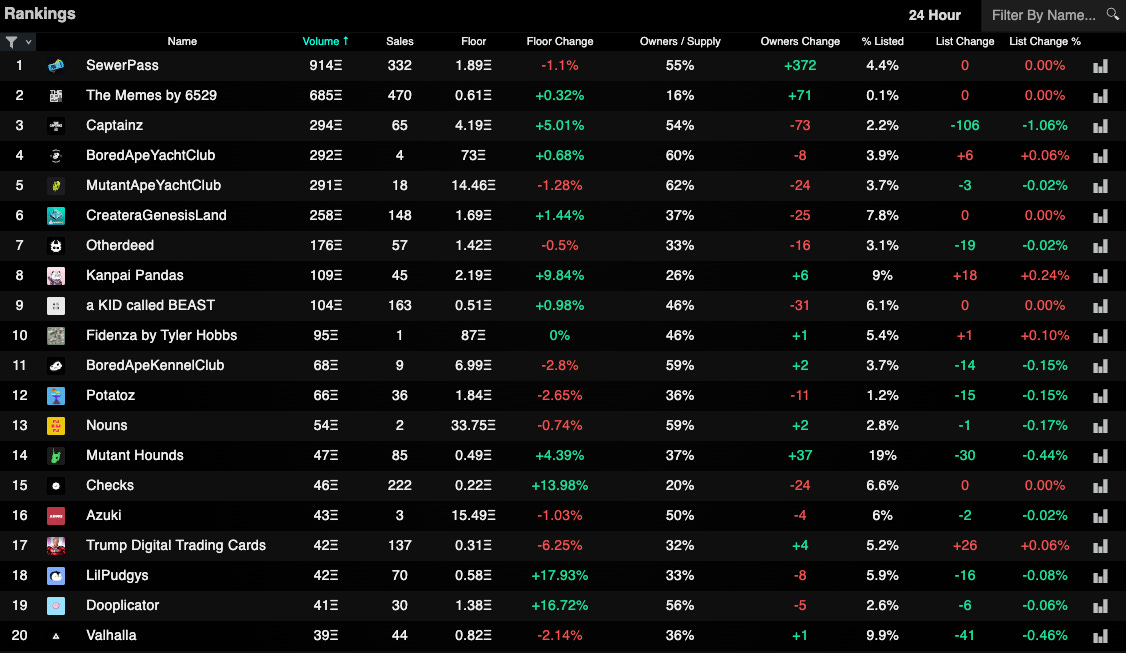

NFTs - NFT volumes are very strong with SewerPasses posting almost another 1K ETH of volume in the last 24H which sees its floor drop slightly back to 1.9ETH. The memes by 6529 continue their parabolic ascent (another one that's impressive given the continuous supply) with the floor now at 0.61ETH on 700ETH of volume, with many of the cards skyrocketing in value. Elsewhere volumes are relatively quiet and floors are mixed, I see a lot of things up 10% and a lot of things down 10%. We still have about 2-3 weeks left before the $BLUR airdrop and I'm still betting that will be a positive event for NFTs, we just have a bit more vol in between.

GL this week!

Comments

No posts