The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

MACRO - Well, this week is a pretty big fucking week! I'll start by recapping that equities ended the week on a strong note closing 0.25% higher on SPX and 1% higher on NDQ, although futures this morning have given back those gains in their entirety. Rates continue to tick higher with 10Y now at 3.53% while oil has dipped back below $80. So, we have to big events this week. The FOMC which is 31st January - 1st February (the press conference occurs on 1st February) and then payrolls on Friday 3rd Feb. IMO we could be setup for a potential negative event around the FOMC, as Powell has so far been adamant about talking things down and highlighting the challenges we continue to face. The thing is, Powell knows he has to talk things down for stocks not to roof, but the market continues to either just not believe him, or disagree with him. My expectation is we'll see more of the same from the Fed, and while stocks may well drop on the back of it, that will be a dip that gets bought and I wonder if stocks will even drop because everyone seems to have figured out the game now. IF for whatever reason Powell is "not hawkish" ie he doesn't really say anything...then I think we could see a pretty big rally across all risk assets. For payrolls on Friday it looks like the consensus is currently 175k. With payrolls, we seem to have been coming ahead of estimates consistently for almost 6 months now. With last month's number being 223k, I think if we come anywhere close to 175k then we will see a market rally. If we come below it then watch out above. So all in - I think risks are somewhat balanced here, maybe possibly skewed towards the upside but just note we may potentially have negative price action around the FOMC. It's all become a game of markets vs the Fed and who is right, but IMO I secretly think the Fed is in agreement with markets, they just want to be prudent and not get ahead of themselves.

CRYPTO - Well we saw some rather juicy price action yesterday as BTC almost hit 24k and ETH knocking on 1700, but we've since receded back down to 23.3k and 1600. Once again, BTC continues to lead the market here while ETH has been having major lag. It's got to a point where it's starting to make ETH look interesting as a buy RELATIVELY vs other coins. I think it's underperformed a lot for almost a month now and it's probably due a correction at some point. A good way to express that would possibly be short BTC vs long ETH to stay market neutral. Elsewhere altcoins continue to be having a good time but we're back lower again this morning in line with the move in majors. It's impressive that $APE has held in a $6-6.3 range for a few days now and I continue to think the rest of what is going on now with the current game/mint (which runs through into mid Feb) could be a strong positive as it once again demonstrates the demand for Yuga products and I think they will be smart at using $APE effectively to underpin their ecosystem. Remember, both Yuga and A16Z have massive $APE bags and these aren't dumb guys, they're gonna try figure out ways to continue to add value to it.

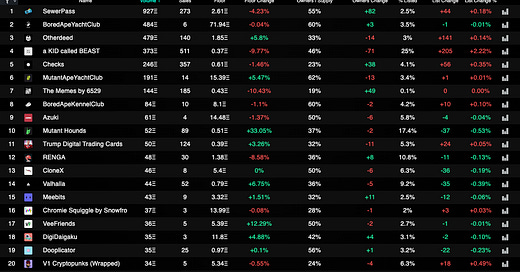

NFTs - I'm still impressed to see another 1K ETH of SewerPasses trade overnight which takes the total volume there to >27K ETH. Elsewhere volumes are solid in the Yuga complex but it seems like price action is mostly mixed across the board, if anything it feels like things are drifting lower with most capital shifting to collecting either open editions or meme derivatives. There's been plenty of money to be made there but IMO you should make sure you're holding onto things for the art and recognise that if you're trying to flip it's going to be a game of hot potato, and at some point liquidity may well completely disappear!

GL this week

Discussion about this post

No posts