The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

**MACRO** - Equities are up this morning after a bit of an anti-climatic day post CPI numbers coming in line. up 0.3% and 0.2% respectively on SPX and NDQ. We saw the tiniest of interest rate rallies over night which takes 2Y back below 5% and 10Y to 4.24%. To repeat what I said yesterday, in the 2 months since we've last heard from the Fed we've had slightly weaker labour market data, rising energy costs causing headline inflation to tick back higher but core inflation coming in meaningfully lower signalling some potential weakness in shelter. All in, I don't think there is enough there for the Fed to change their tune next week at the FOMC (19th-20th September, press conf and rate decision is on 20th). Personally, I also think there is not a need to raise interest rates, had we had a continuation of strong labour market data I think they would have done it, but there are clear signs of it weakening across a few different datapoints. Indeed, the market is expecting a 97% probability of the Fed maintaining, ie NOT hiking (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html). I think if we see a continuation of weaker labour market data for the next two months, there is a good chance we see some communication of potential rate cuts for next year. That's what Powell has been focused on and we know there is a lagged effect on shelter/housing with high rates for almost a year we can expect that to eventually take effect. Let's see.

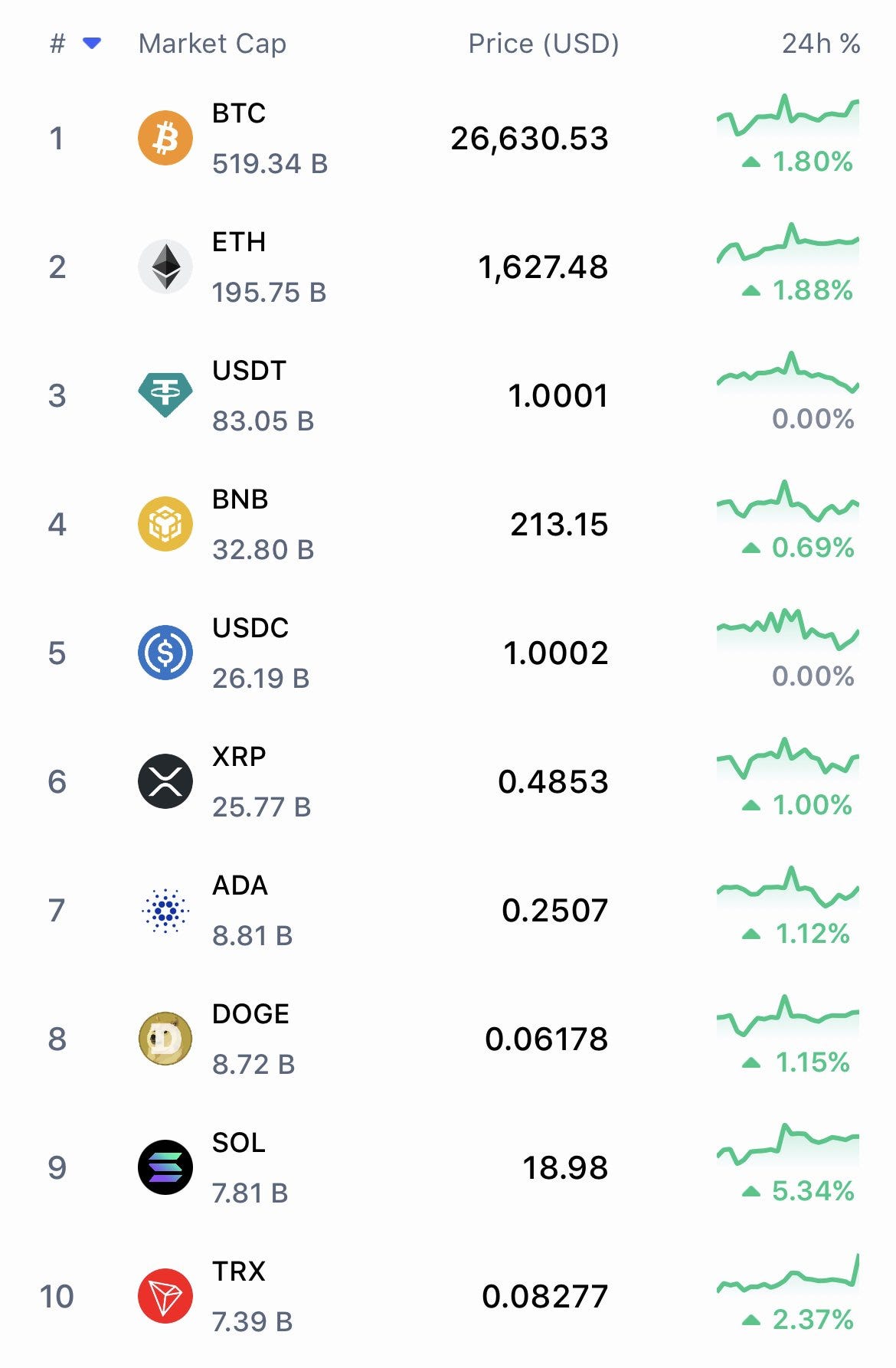

**CRYPTO** - BTC continues to lead the way a little here edging a touch higher again to 26.5K while ETH has climbed to 1625. The ETH/BTC ratio remains at 0.061 (the lowest it's been in a month) and Bitcoin dominance at 50.1%, the highest its been in a month. So there is a quite clear outperformance of BTC here (having seen it underperform) and the reversal suggests to me some of the technical forced selling may have subsided. I would note that open interest on both BTC and ETH ticked up by 3.4% in the last 24H along with a rise in price which suggests to me there are some levered longs building; not necessarily a concern but we've seen any leverage in majors get wiped out pretty fast of late. Altcoins are a bit meh but would note a decent 20% bounceback in $bitcoin (hpos10) and believe that leads the way for a lot of other memecoins so keep an eye on that.

**NFTs & Misc** - Most noteworthy mover was Nakamigos which plummeted 50% down to an fp of .19 after it was revealed their big announcement in Fall was simply another paid NFT drop. I suppose I'm not sure what people were expecting but at the very least I think they were hoping for a free drop rather than a paid one. For me, this turns out to be yet another cash grab with zero care for the fragile state of NFTs at the moment. The move took a toll on the entire market as everything dropped a further 5-7%. Meanwhile activity on Friendtech continues to surge with it generating $1.2m in fees yesterday, more than Tron and Bitcoin. Like I said yesterday, I think there is an extremely good chance that FT absolutely explodes in the next few weeks, it has all the DNA to do so; I would just not put in too much money and make sure you take profits because inevitably it has a strong chance of a blow off top and then everyone nukes and exits. Last thing to mention is Stoner Cats were charged by the SEC yesterday, looks like mainly on the grounds of them implying their expertise could cause NFT prices to rise in value and the encouragement of secondary trading. I think it's a flakey argument but would expect more SEC fines coming to a bunch of different projects, especially those with revenue sharing which makes something a clear security.

GL today!