The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

**MACRO** - After a solid day yesterday futures are opening a touch lower, down 0.25% and 0.3% on both SPX and NDQ. Interest rates have edged back higher over the past few sessions which takes 2Y back above 5% and 10Y now at 4.28%. This is an important week as tomorrow we get inflation numbers. The consensus numbers are finally out and it looks like inflation is expcted to rise to 3.6% vs last month's 3.2%, but most of this will be as a result of higher oil prices and core inflation is expected to drop to 4.3% from 4.7% last month and I think this will be the number which will be the one to really focus on here...core inflation I think was close to flat last month so if we do see it lower it's pretty constructive for the market imo, especially at a moment in time where rates have sold off a substantial amount. I think what will be more important in terms of tone setting will be the FOMC next week but this is the first step.

**CRYPTO** - Well we are really all over the place, the fear on FTX dumping a tonne of crypto caused ETH to drop to as low as about 1530 yesterday and BTC to as low as almost 25k. It appears most of this move was as a result of a short squeeze and we had a pretty strong rally back this morning with a lot of open interest being wiped out. Personally, if you look at the FTX stuff I think it's a bit of a silly thing to short into (but maybe explains some weakness we've seen in the past few weeks). It's unlikely they dump the entire portfolio in one go, they will probably work with a market maker to gradually wind it down as to maximise proceeds. I don't think we'll see much crypto movement in the way of macro stuff next few days but I am still holding onto the fact we have a slew of potentially very positive headlines to come and I think this move lower and fear incitement feels intentional and manipulated to me...it's rather classic to suddenly see the whole timeline bearish at multi-month lows for crypto and my gut is we still end the year a lot higher than where we are now (but of course you have to discount everything I say as I'm perma-bullish at these prices).

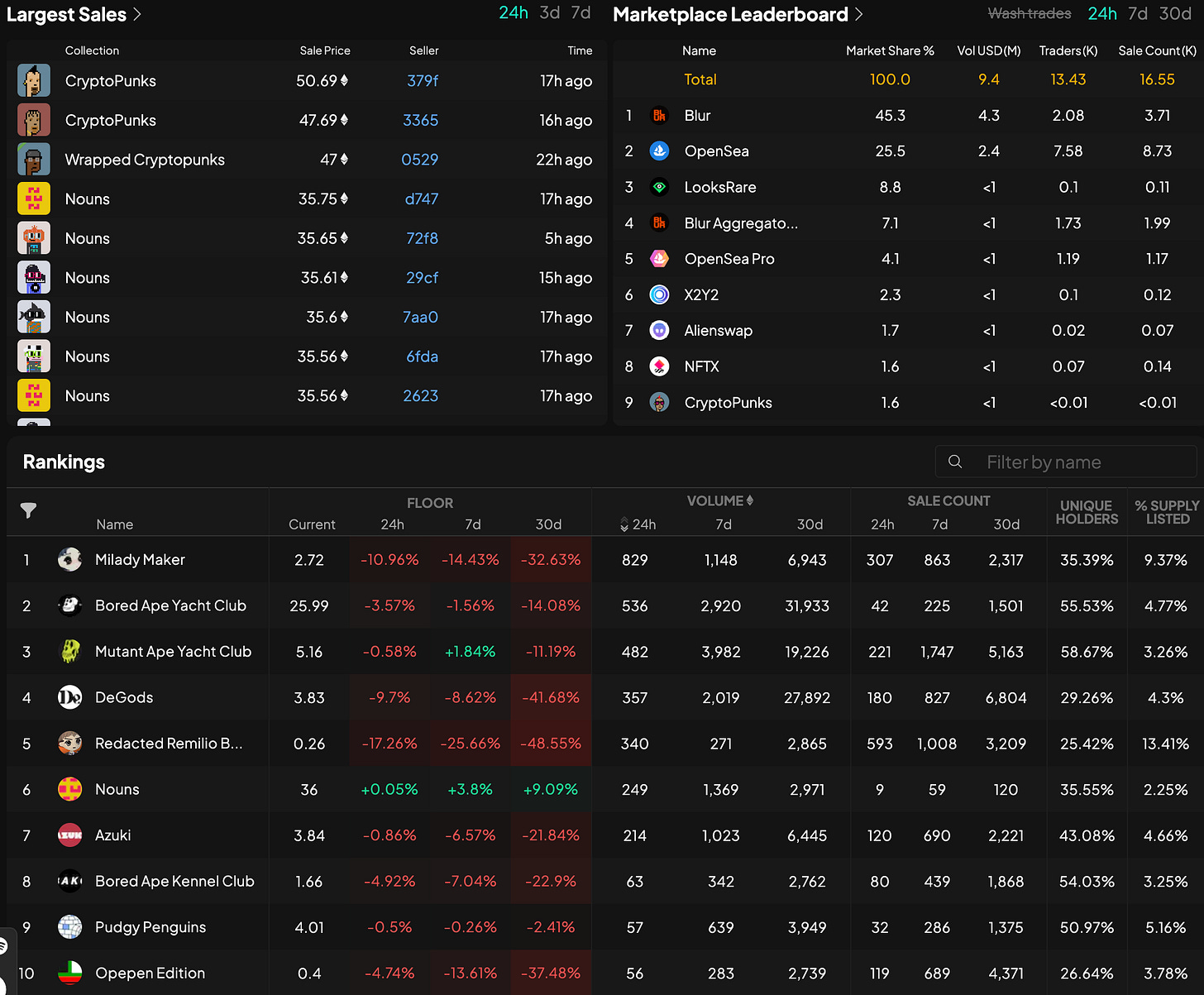

**NFTs** - The biggest mover has been Milady and Remilios after it turned out all or part of the Bonkler treasury (another project within the RemCorp world) was compromised by internal team members and stolen. Allegedly it should not impact any of the existing NFTs etc but of course any security compromise is not great. Miladys are down to a floor of 2.72ETH (-11%) and Remilios down to 0.26ETH (-17%). Elsewhere price action seems to be mostly south in what appears to be death by a thousand cuts; a little lower every day. Sentiment for NFTs (mainly pfps) has been horrific this year but honestly I do get surprised by how worse it can actually get each day. At this point, unless it's an art/culture/meme type NFT I see very little focus on it from most people I have conversations with. Reality is if you have bills to pay (whether you're a corp or an individual) then you have to start looking elsewhere or are forced to make a move.

GL today