The information in this message does not represent any financial or investment advice. They're just random thoughts in my head.

gm

MACRO - Stocks had a tough day yesterday ending about 1.3% and 2.1% lower respectively on SPX and NDQ. IMO this is perhaps in anticipation of this week's FOMC which starts today and concludes tomorrow. If we continue to sell off today (futures already down another 0.5-0.7%), then I think there's a case to say that even if the Fed is once again hawkish on Weds, a more pronounced sell-off could be muted. At this point I really do think everyone is expecting them to be hawkish so gotta think a lot is getting priced in here. We also get the Fed's interest rate decision and at the moment the consensus is for a 25bp hike to 4.75%, this would take the Fed just a 25bp hike away from their terminal rate of 5%. There is possibility of a 50bp hike which is what Bullard alluded to earlier this month, I think we would see a bit of a sell-off if that happened. Wrt interest rates I don't really expect a huge move either way with us now being close to the Fed's terminal rate and economic data going in the right direction for them not to want to change that.

CRYPTO - We saw a pretty decent move lower yesterday in line with macro which took BTC to 22.8k, ETH to 1568 and most alts down about 10% or so. I don't think there's anything untoward here other than a move in line with equities and we will certainly regain some beta given the macro events and datapoints we have this week. We talked a lot about how ETH had underperformed BTC and it's interesting to see that underperformance seems to have at least stabilised now with the ratio maintaining at around 0.069 for a couple of days now. That point in the ratio seems to be a longer-term support point so I'm curious to see and wonder if that makes ETH look like an interest buy here relative to other coins.

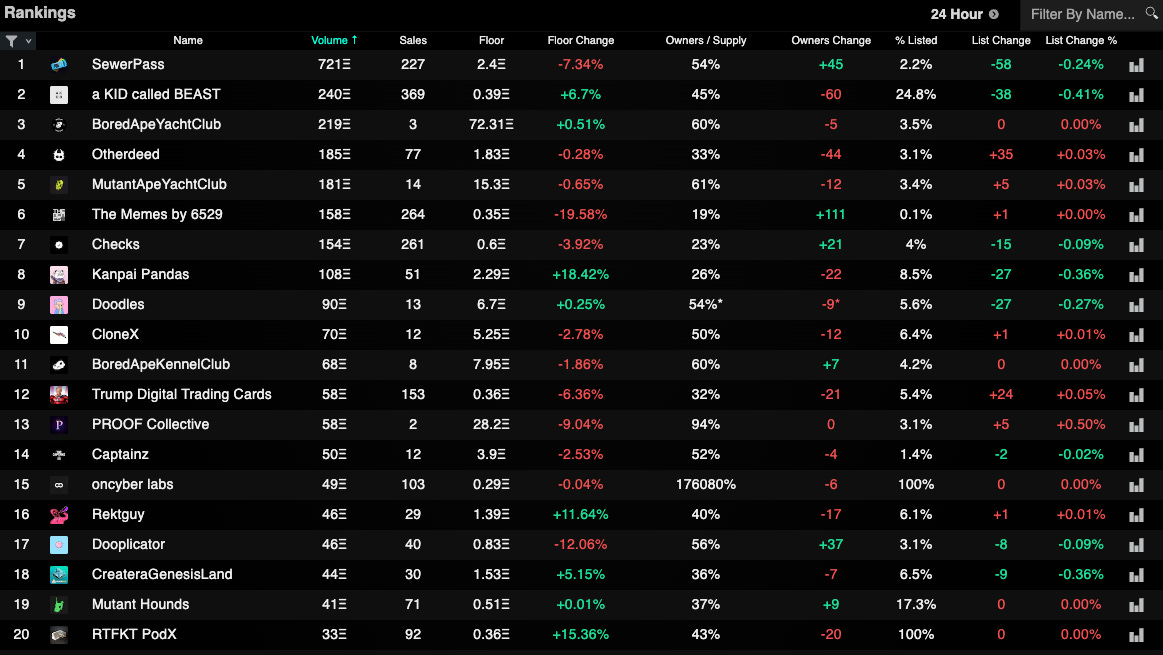

NFTs - Well, you guessed it, Sewer Passes top the volume charts once again with another 700ETH trading overnight although we've seen the FP drop from recent highs of 2.9ETH. Elsewhere price action seems to be mostly in the red, notably, the 6529 memes have dropped about 20% to a floor of 0.35ETH. Unsurprisingly, we've also seen a lot of OEs drop below mint price too. Once again, if you're simply in it for the art then it doesn't really matter there, but I think we can safely assume a large amount of people aren't:

and so I continue to expect downward price action as people move onto the next "hot thing". We all seem to have forgotten a little bit about the $BLUR airdrop and that's about 2 weeks away now. My thoughts on that are still that we will see an initial dump of $BLUR, but then the token could actually rally as everyone will fade it. I do believe it will have a strong stimulus effect into the NFT market and as such I would expect focus to return to the more "traditional" pfp collectibles.

GL today!